How Much Does It Cost To Register A Corporation In California

Do Information technology Yourself

Sign up for a free business relationship and use our online tools to beginning your California corporation today. Includes California incorporation and maintenance walkthrough and company document creation. All for free—just pay state fees.

$ 0 Total

Become Monthly

Skip the state fees! Get a California corporation and the best of our services today. Includes EIN, business address & mail forwarding, hassle-gratis maintenance, Privacy by Default®, local Corporate Guides®, and everything you need to operate at full capacity.

$ 47 / Month

Pay in Total

Get California corporation , business address & free mail forwarding, costless 60-twenty-four hours Phone Service trial, Privacy past Default®, lifetime support from local Corporate Guides® and a twelvemonth of registered agent servic e .

$ 350 Full

Rated four.5 / 5 stars by 317 clients on Google

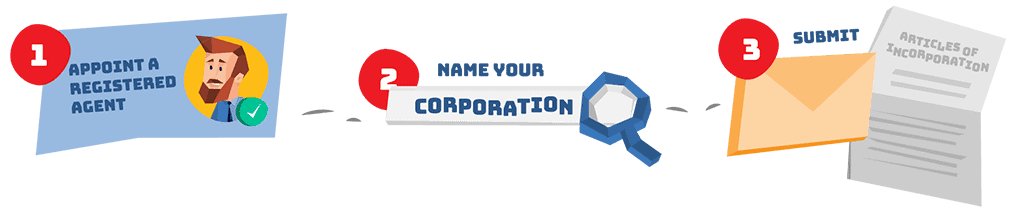

To start a corporation in California, you'll need to do three things: appoint a registered agent, cull a name for your business, and file Articles of Incorporation with the California Secretary of State. You lot tin can file this document online, by mail, or in person. The articles cost a minimum of $100 to file. Once filed with the land, this certificate formally creates your California corporation.

one

Appoint a Registered Amanuensis

Per CA Corp Code § 1502, every California corporation must appoint a registered amanuensis (as well called an "agent for service of process"). You don't need to hire a registered agent, just if you do, make sure your registered agent will listing their address on your articles wherever possible to ensure maximum privacy.

2

Proper name Your Corporation

If you're starting a new business, yous probably already know what y'all desire to proper noun your corporation. Just you'll need to know if your preferred name is bachelor. To find out, visit the California SOS business entity database and search until y'all notice the perfect proper name for your corporation.

three

Submit California Articles of Incorporation

Once you know who your registered agent will exist and what your corporation name is, you lot're gear up to file your California Articles of Incorporation. Follow along with our filing instructions below:

Larn more than nearly each Manufactures of Incorporation requirement below. Notation that the data y'all provide becomes function of the public tape—permanently.

Ameliorate notwithstanding, skip the form entirely and rent us to comprise your California business. We provide a gratuitous business address to list whenever possible throughout the filing to meliorate keep your personal address individual. And for the cheapest manner to commencement a concern? Pay just $47 out the door with our VIP monthly payment pick.

1. Corporation Proper name

The name of the corporation must comprise the give-and-take "corporation," "incorporated," or "limited," or an abbreviation of ane of those words. The proper name cannot be likely to mislead the public.

2. Business Accost

This street address will go function of the permanent record of your California corporation. (A unlike mailing address can too be included.) Hire Northwest every bit your registered agent and y'all can maintain address privacy by using our California address as your business address.

iii. Agent for Service of Procedure

Your California registered agent (chosen an "agent for service of process" in California) tin can exist an individual California resident or a registered corporate agent such as Northwest. If you appoint an individual equally your amanuensis, yous'll need to include their name, as well as the street address where they'll be available during regular business hours to accept legal notices on behalf of your business organisation. If y'all appoint a corporate agent, you'll only demand to include the business organisation name. No need to list the address—it's already on file with the state of California. Hire Northwest, and nosotros'll be your agent.

four. Shares

Enter the number of shares the corporation is authorized to issue. (Aka: how many shares are you initially creating?) You must create at least ane share. You'll distribute some or all of these shares afterward on at your organizational meeting. Want to have different classes or series of shares? Yous won't be able to use the standard Articles of Incorporation form; yous'll have to draft your own articles instead.

5. Purpose Statement

Though a purpose statement is required, California has taken the liberty of writing the statement for you, and it cannot be altered. So, you tin can skip this step. (On the online class, the purpose statement appears in the first section, forth with your corporation name.)

6. File Date

On the online form, you take the option of choosing to have your articles filed immediately or on a future date (up to xc days in the future). Most businesses volition want to start right away, but i common reason for delaying the process is if you're close to the next tax year.

7. Incorporator Signature

Someone has to sign your Articles of Incorporation, and that person is your incorporator. Your incorporator doesn't take to exist a director, officeholder or anyone in the corporation—just someone you authorize to sign the grade. On the online form, yous'll demand to include an email address as well. When you rent Northwest, we'll be your incorporator.

Professionals in California hire registered agent services like Northwest Registered Agent for incorporation—merely why?

Logistics

Standard filing companies don't have employees or offices in every country. But equally a national registered agent, information technology's a requirement for us, which is a benefit for our clients. We own our own building in Redding, CA. We're on a outset name ground with the people who work in the Secretarial assistant of State's role. We know all the fastest filing methods, which translates to fast, professional service—without actress fees.

Privacy

As your registered agent, we list our Redding registered part address on your corporation's formation documents. Why? If you lot're starting a business concern from your flat in San Francisco, do you really want your apartment address every bit your business address? (Hint: the respond is no.) We'll list our address, so you don't have to list yours. Plus, we never sell your data. We don't list your personal information on filings if we don't have to. It's all standard and function of our commitment to Privacy by Default®.

Free Mail Forwarding, Business organisation Address and More

At Northwest, we exercise everything a registered amanuensis should do and more. You can list our address equally your business address on your country filings. We include limited digital mail service forwarding with registered amanuensis service (up to 5 pieces of regular mail per year; $15 a medico after that).

Plan on accepting credit cards? We likewise offer a Free Credit Bill of fare Processing Consultation. Our specialists work with processors to negotiate low rates and better contracts for our clients.

And now, endeavor our in-house Northwest Phone Service for 60 days, free of charge with our formation service. Become a virtual phone number with your choice of area code, make and receive calls from whatever device, and more—for just $ix a calendar month.

Local Expertise

Nosotros know the in's and out's of each country—and we apply this cognition to aid you lot when y'all need information technology about. Our team of Corporate Guides® has over 200 local business experts. Yous tin can call or e-mail united states of america for answers to all your questions most your corporation in California. Our Corporate Guides are defended solely to helping you with your business—not selling you lot services or coming together quotas.

Afterward your California Articles of Incorporation are canonical, you still have a few more of import steps to take, including getting an EIN, drafting bylaws, holding your first meeting, opening a bank account, and learning about country reporting and tax requirements.

Go an EIN

Your federal employer identification number (unremarkably known as an EIN or FEIN) is like to a social security number for your concern. The IRS assigns these numbers and uses them to hands identify individual corporations on tax filings, including federal corporate income taxation returns.

Why does my California corporation need an EIN?

The IRS requires corporations to become an EIN for their federal tax filings. You lot may likewise be asked for your EIN when opening a bank business relationship, securing a loan, or applying for local concern permits and licenses.

How practice I get an EIN for my corporation?

You can get an EIN direct from the IRS. The application is free, and most businesses can utilize online. However, if yous don't have a social security number, yous'll need to submit a paper application course. Can't conduct to make full out even so another application? Hire Northwest to go your EIN for you. Just add together on EIN service during checkout when you sign upwards for our incorporation service. Or choose our VIP service—an EIN is included.

Write Corporate Bylaws

Bylaws are the internal rules you set for your business. They put into writing how decisions volition exist made and who gets to make those decisions. All the major organizational processes and procedures for your corporation will go in your bylaws.

For more on California Corporate Bylaws (including free California Corporate Bylaws templates), see our California Corporate Bylaws resource.

Do I demand bylaws for my California corporation?

At that place is not a specific state statute that says a California corporation must have bylaws. An exception to this can be constitute in CA Corp Lawmaking § 212, which says that if the number of directors is not stated in the articles of incorporation, and then that information needs to be included in bylaws.

Yet, bylaws shouldn't be ignored simply considering the law generally allows it. Corporate bylaws are one of your almost of import internal documents. Without bylaws, the operating rules of your corporation volition default to any the country statutes declare. Practice yous actually desire the ins and outs of your corporation to be dictated past the state? (Hint: no, you don't.)

What should bylaws include?

Corporate bylaws cover basic policies and procedures for issues such equally company finances and management. Bylaws should cover a range of topics, answering key questions similar those below:

-

Meetings: When and where will meetings for shareholders and directors be held? How many attendees are required to transact business? What are the procedures for voting or proxy voting? How do y'all phone call a special meeting? What deportment tin exist taken without a coming together?

-

Stock: How are stock certificates issued and transferred? How is voting affected past issues such as corporate stock owners or partial shares?

-

Directors and officers: How many directors must there be? Which officer positions are required? What powers do they accept? How practice you fill a vacancy or remove a managing director or officeholder?

-

Finances: What are the procedures for retaining profits, issuing dividends, and paying bills? Who can withdraw coin from the corporate banking company account or sign checks?

-

Records: Where is the corporate book to exist kept? What information volition be maintained? How are requests for review or access honored? Can records or copies exist kept or distributed digitally?

-

Amendments and emergencies: Who tin can improve bylaws and how? Can emergency bylaws exist adopted in the example of disaster?

California bylaws can as well brand other provisions and go into more detail on the above topics, assuming additions are in accord with state law. For example, CA Corp Lawmaking § 212 states that California bylaws can determine the qualifications, duties, and compensation of directors.

How do I write bylaws?

Creating bylaws can be overwhelming—where practice you offset? Northwest tin aid. We requite you free corporate bylaws when you rent u.s.a. to form your California corporation. We know what kinds of topics and questions corporations need to address, and we've spent years refining and improving our forms. Nosotros offer many other free corporate forms every bit well, including templates for resolutions and coming together minutes.

Hold an Organizational Coming together

An organizational meeting is the first official meeting of the corporation after the business is legally formed with the country. At this meeting, bylaws are adopted, officers are appointed, and any other initial business is conducted. The commencement meeting minutes should likewise be recorded and added to your corporate tape book.

Are in that location whatsoever special rules for California organizational meetings?

If shareholder voting will take place at a meeting, written observe of the meeting must exist given at least 10—but not more 60—days prior to the meeting. The meeting doesn't have to be held in California, unless the bylaws say otherwise.

Open a Corporate Bank Account

Businesses that mix personal and business finances together adventure losing their liability protections, so your corporation volition need its ain bank account. In addition, a corporate bank account is essential for easily accepting payments, paying bills and belongings funds.

How do I open a bank account for my California corporation?

To open up a corporate banking concern account in California, you'll demand to bring the post-obit with you to the bank:

-

A re-create of the California corporation's Articles of Incorporation

-

The corporation'due south bylaws

-

The corporation's EIN

If your bylaws don't specifically assign the ability to open up a banking concern business relationship, you may likewise want to bring a corporate resolution to open a bank account. The resolution would state that the person going to the bank is authorized by the business to open the account in the name of the corporation. At Northwest, we provide free corporate banking company resolutions, forth with many other gratis corporate forms, to help yous get started fast.

File California Reports & Taxes

In California, corporations file a statement of information each year. The state too has a franchise revenue enhancement, which both South corporations and C corporations are responsible for paying.

What is the California Statement of Information?

How much is the California Argument of Information?

The California Statement of Data filing fee is $25. If yous file late, you lot receive a 60-solar day grace menstruum before you're hit with a $250 late fee.

When is the California Statement of Data due?

Your initial argument of information is due within 90 days of your corporation'southward formation. When yous hire Northwest Registered Amanuensis to grade your corporation, we will file your initial statement of information for y'all!

In subsequent years, the statement is due past the last 24-hour interval of your anniversary calendar month (the month your corporation formed).

These filings can be easy to forget—which is why nosotros send our clients automatic reminders. Or better yet, let us file for you. With our concern renewal service, we tin consummate and submit your almanac report for you for $100 plus the land fee.

What should I know about California taxes?

Regardless of whether your corporation is taxed every bit an S corp or C corp, plan on paying at to the lowest degree $800 a yr in entity-level taxes.

S corps in California are responsible for paying the state's franchise taxation, which is essentially a tax for the privilege of doing business in the state. The franchise tax rate for Southward corps is one.5%, with a minimum payment of $800. The revenue enhancement render and payment are due by the 15th twenty-four hour period of the 3rd month later on the close of your corporation's taxable year. (For example, if your corporation's taxation year ends in Feb, your tax return would be due past Apr 15.)

C corps are also responsible for paying the state's franchise tax (alternatively referred to as corporate income tax). The minimum taxation owed is still $800, though the rate is significantly higher than for S corps—8.84%. The taxation return and payment are due past the 15th day of the fourth month after the close of your corporation's taxable year. (For example, if your corporation's tax year ends in February, your tax return would exist due by May xv.)

An exemption to the franchise tax occurs if your corporation's tax year is 15 days or less, and if no business was conducted during that time.

California corporations should also be aware of the state'due south sales tax, which is 6%. Urban center, county and specialty sales taxes can be tacked on equally well. The highest sales tax rate in the country tin be found in Santa Fe Springs, at 10.5%, though the state's boilerplate is 8.258%.

Do corporations have to register with the California Franchise Taxation Lath?

Yep. All businesses are required to file returns with the Franchise Revenue enhancement Board. You tin can annals by creating an account with MyFTB.

How tin can I submit the California Articles of Incorporation?

Yous tin file California articles online, by post, or in person. Mailed filings must be submitted to the post-obit accost:

Secretary of State

Business organization Entities Filings Unit

PO Box 944260

Sacramento, CA 94244-2600

In-person filings can by and large be delivered to 1500 11th St., 3rd Flooring, Sacramento, CA 95814. However, during the COVID-19 pandemic, drib-off boxes are bachelor in the office's lobby.

How much does it cost to starting time a California corporation?

The filing fee for Manufactures of Incorporation is $100. Inside 90 days of filing, the initial statement of information is due and costs $25. So, the minimum grand total for forming a California corporation is $125.

Expedited processing tin can be yours if you're willing to dig into some deep pockets—same-day processing is $750 and 24-hour processing is $350. (Expedited service is suspended during the COVID-19 pandemic.)

Rent the states for a one-fourth dimension fee of $350, including the state filing fees, initial statement fee, a year of registered agent service, a business concern address and more. Or, pay just $47 out the door with our VIP monthly payment option.

How long does it take to start a California corporation?

Filing times vary based on your filing method. If your manufactures are dropped off or mailed, it could take as long as 4 weeks for them to process. If filed online, it may accept up to ii weeks during decorated periods, only is usually much faster.

If you lot hire Northwest to start your corporation, nosotros file online and typically have your California corporation formed within v days.

Does a California corporation demand a business license?

Yes. California corporations are required to have a business license, but the state doesn't actually issue licenses itself. Instead, licenses are issued at the local level. You'll accept to utilize for your necessary license(southward) from the city and/or county where your LLC is registered. For example, Santa Monica requires all those conducting business organisation within the city limits to obtain a general business license. The same is true in San Jose, though the license is called a Business Tax Certificate.

For some license applications y'all may need an EIN or a certified re-create of your Articles of Incorporation. At Northwest, nosotros can streamline the procedure and get these for you—simply add together on these items during checkout.

What is a foreign California corporation?

A corporation formed outside of California—but which conducts business in the state—is considered a foreign California corporation. For example, if you incorporated in Oregon but decide to open a storefront in California, you lot would be a strange California corporation. This also ways yous would demand to register with the country past filing a Argument and Designation by Foreign Corporation with the California Secretary of Country. Strange corporations are required to file the California Statement of Information each year as well.

Can Northwest help me form a nonprofit corporation?

Absolutely! Nosotros're happy to start a nonprofit corporation for you. Note that incorporating a California nonprofit requires a dissimilar form and the filing fee is lower. California nonprofits may not need to file the country's franchise taxation merely must file a statement of information every two years ($20).

How can I go a California telephone number for my corporation?

It's a conundrum: you demand a local number to brandish on your website and give to customers, but you don't want to make your personal number quite so…public. Nosotros go it. And nosotros've got you covered with Northwest Telephone Service. We can provide you with a virtual phone number in any state—plus unlimited telephone call forwarding and tons of easy-to-use features. You tin can effort Phone Service gratuitous for 60 days when yous rent united states to form your corporation, and maintaining service is just $9 monthly after that. No contract required.

Our California incorporation service is designed to exist fast and easy—signing upwards takes only a couple minutes. Here's how it works:

1

Signup

We o ffer flexibility with ii different option s for payment. Yous can pay everything upwards front end, which includes a full year of registered agent service. Or, pay just $4 seven out the door with our VIP monthly payment option. With our VIP option, we also include an EIN. Just choose 1 of the buttons below, answer a few easy questions virtually your concern and s ubmit your payment.

ii

State Approval

Next, we'll set up and submit your California Articles of Incorporation to the Secretarial assistant of Land, Concern Entities Filing Unit. In the meantime, y'all'll have immediate access to your online account, where you tin find useful state forms, pre-populated with your business organisation information.

3

Your California Corporation!

Once the California Secretarial assistant of State has canonical your filing, we notify you that your California corporation has been legally formed. You can at present move on to side by side steps, like holding your organizational meeting and opening a bank account.

Source: https://www.northwestregisteredagent.com/corporation/california

Posted by: broderickthroosed.blogspot.com

0 Response to "How Much Does It Cost To Register A Corporation In California"

Post a Comment